Heading into Q4, we look to see a continued rally in risky assets as investors continue to selectively buy the dips. The driver behind this is twofold: expectations of an economic rebound, particularly centred on China, and the continued momentum of the ESG theme. Hence, we are focused on Chinese equity, EM Bonds with their currency carry trades and new breakthrough technologies that benefit from low interest rates.

Implications

To deal with periods of overshoots and diversify, we suggest building up flexible solutions that can allocate between different risk premia. We expect a predictable consolidation in the next two months, but we should see risk perform well till the end of 2021 driven by abundant excess liquidity. Some styles, such as Growth, should continue to de-anchor strongly from reality and generally see an increase in return dispersion. In such times, the analysis of trends, sectors and names can make a substantial difference.

A China centric economic rebound

The South China Morning Post recently reported comments from officials that economists are revising up their growth forecasts for China and the odds are that the Chinese economy runs faster than official data would suggest. Households are steadily returning to their normal pace of consumption while global demand for exports should steadily help.

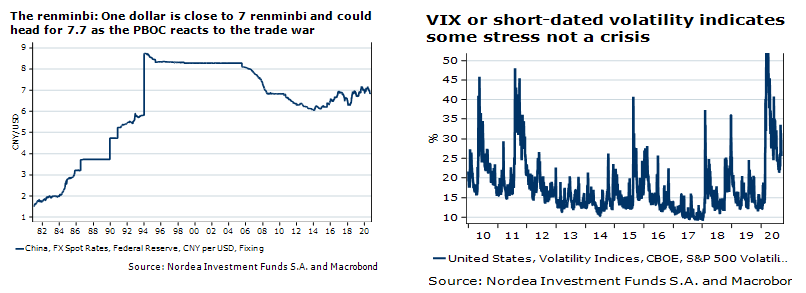

We maintain our bullish China thesis with this positive impulse slowly spreading to the rest of Asia Pacific. In particular, we remain focused on the innovative IT sector and a rising middle class. Investment flows into Asia Pacific and Emerging Markets should support these currencies but interventions to stem some of their appreciation should support the euro against the dollar, as foreign reserves diversify out of the dollar. Hence, we remain selectively constructive on EM Bonds as analysis is paramount in Emerging Markets. For example, the Renminbi offers a very sound risk adjusted carry.

Implications

Some have termed this the “buy everything rally”, but this is an overblown sentiment. What we are seeing is a cluster of themes: 1) Growth/IT 2) Quality 3) China 4) Credit 5) ESG, followed by a broader bid for risk. The question is whether we will see stability and we expect some degree compared to the usual rotation every few months.

ESG values are gaining momentum

Raging fires and red skies over San Francisco are a stark reminder of the importance of ESG. For decades, efficient capital allocation has driven the market. It still does, to a large extent. But ESG concerns are no longer limited to a few progressive dreamers. ESG plays an increasingly important role in the efficient allocation of capital. As more and more investors prioritize ESG in their asset allocations, resource efficiency solutions are gaining an advantage, encouraging energy producers to continue to diversify.

Implication

The integration of the ESG approach is becoming more the norm in the industry and will extend to most asset classes. There is also a shift to more impact-oriented investments with measurable impact Key Performance Indicators (KPIs). This movement has started already. Asset managers are increasingly concerned about all factors that are material to clients’ investments, including those that are non-financial, namely ESG factors. We expect ESG to gain more traction in the US and Europe.

Excess liquidity and an economic recovery should help the carry trade

Excess liquidity defined as negative real rates, money growth above GDP growth or central bank balance sheet growth above GDP growth has long been seen as a forward leading indicator for economic growth and risky assets. The reality is more complex. The announcement of a very expansive monetary policy may surprise the market initially, but the market learns to anticipate this, as has happened in the various phases of the Federal Reserve’s Quantitative Easing program. Nonetheless, the market was still surprised by the speed of the economic rebound this time around. With such a powerful monetary impulse coursing through the US and European economies, the odds are that the market will be surprised again positively in Q4 and 2021.

What does it mean?

We will likely remain in a “buy the dip” market until inflation is anticipated to return to slightly above target in the United States, e.g. 3% in 2022/2023. The risk of such a scenario suggests keeping some hedges.

Conclusion: Buy on dip, but consider flexibility

The aggressive easing by the Federal Reserve and ECB should help growth rebound more quickly than is currently expected. The sense that they will step in if markets tumble also reinforces a buy the dip mentality. In particular, we are focused on an economic rebound driven by China and momentum in ESG.