In tumultuous markets, investors must meet fundamental challenges with fundamental investing

Cristian Balteo, Product Manager

Key points

- Market conditions are forcing investors to re-evaluate their positions.

- New fundamental economic challenges may best be met with fundamental investing.

- Nordea 1 – Global Stable Equity Fund invests in companies with strong business models, “stable” profits, robust balance sheets and attractive valuations. This approach has historically offered a degree of protection in falling markets while still enabling investors to participate when markets rise.

Today’s challenge

The world – and the global economy – has been rocked by the war in Ukraine. Coming on the back of pandemic-related supply chain disruption, inflationary pressures are now forcing central banks to act. After more than a decade of low interest rates, investors are now facing rising inflation, rising interest rates and the possibility of a hard landing. Where can they turn?

As markets are hit by these difficulties, investors need to meet fundamental challenges with fundamental investing.

Fundamentals point us towards assets that can generate the kind of returns that can offset the impact of inflation. This suggests equities – but equity risks have risen. So, how can investors capture real returns while at the same time finding an element of downside protection? The answer: be very selective in the stocks you put into your portfolio.

How to meet the current challenge

Investors need companies that can withstand fundamental pressures – inflation, interest rates, economic weak-ness – while still being able to grow their businesses. We believe these are companies with steady earnings and robust balance sheets that can act as a stabiliser, providing an element of protection against both economic downturn and rising interest rates. These are the companies Nordea 1 – Global Stable Equity Fund invests in.

What does “stable” mean to us?

When we target stability, we are aiming for a lower volatility portfolio . There are several components to this, starting with a stable universe of stocks.

Our stable universe

Our investment universe is made up of high quality companies with steady earnings. These companies are typically less economically sensitive than the market in general, producing products or services that many might consider to be staple goods meetings basic needs, whether this be basic food and personal care items or the provision of utilities or certain IT goods and services. These companies will see relatively consistent demand throughout the economic cycle, but this alone is not enough. We seek out companies whose consistent demand is complemented by pricing power. Companies with pricing power are better able to pass on cost increases, thereby ensuring that sales rise in an inflationary environment (even without volume increases). The final step in our equation is a strong balance sheet, ensuring that sales growth translates into earnings growth. As a result, such companies offer an element of inflation protection without being highly cyclical and vulnerable to recession.

Our stable shares

In our eyes, a stable company isn’t automatically a stable share. Valuation plays a key role as we select holdings. We require a fundamentally attractive valuations for our stable companies, because we have seen very clearly how high valuations themselves bring additional volatility to shares. Companies trading on very high valuations are subject to sentiment far more than those whose ratings reflect their fundamental prospects. This is why we typically avoid companies with unrealistic valuations, instead finding opportunities in high quality companies that may have been left behind.

Our portfolio’s stable shares are actively managed

Our stock selection process has several implications for the portfolio. One important thing to note is that our focus on valuation means our portfolio is actively managed and will change as valuations change. Companies remain stable but their share prices do not, so while our universe remains fairly fixed over time, the holdings in the portfolio change as companies’ valuations move in and out of our valuation zone.

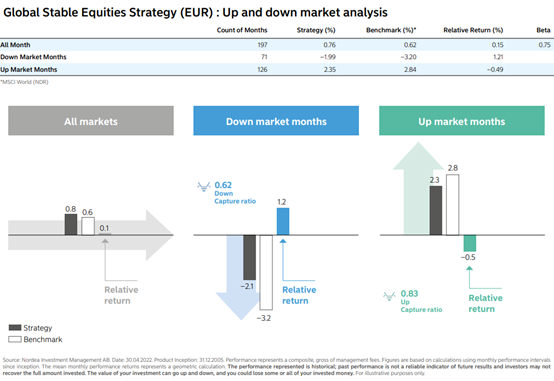

The most important outcome of our investment approach is that our portfolio’s performance is generally less volatile than the market, while at the same time still capturing upside returns. We look at this as downside capture vs upside capture. The chart below shows you that since we started this strategy (31.12.2005), in the months when global equities (MSCI World) have fallen, the portfolio fell only 62% as far as the index. In the months when global equities went up, the portfolio went up 83% as far as the index. Because it is doing better (compared to the benchmark) on the way up than on the way down, the portfolio has generated long-term out-performance. More importantly, it offered a degree of protection in falling markets without losing too much potential upside performance in rising markets2. As we enter a period of great uncertainty for equity markets, isn’t this exactly the profile investors want?

Case study: Alphabet

Alphabet, the company which owns Google, has enjoyed strong earnings growth for over 10 years, driven by its lead-ing positions in web activities ranging from its search en-gine through maps, mobile operating systems, consumer content and advertising.

- Sales: Not economically sensitive – secular growth driven by continued growth in mobile usage, video usage, Google Play activity and connected device growth.

- Pricing power: Yes – owns leading search technology, Android and YouTube.

- Profitability: Good – strong expense discipline means that sales growth translates into earnings growth.

- Balance sheet: Robust – no debt and high return on capital.

- Valuation: Attractive, both in absolute terms and relative to the market, especially when we consider its consistent earnings growth and strong balance sheet.

How Nordea 1 – Global Stable Equity Fund could meet your current needs

With markets oscillating, many investors do not want to retreat from equity markets completely but neverthe-less would like to reduce their portfolio risk levels. Thanks to its universe of high quality companies with steady earnings and strong balance sheets, combined with a focus on valuation that gives a firm fundamental under-pinning to our stock selection, Nordea 1 – Global Stable Equity Fund has been able to deliver a return profile that offers investors downside protection without compromising too much on returns in positive markets3.

The nature of the companies we invest in means they should be well-positioned to meet inflationary pressures and enjoy continuing growth even during periods of economic weakness. Furthermore, this may bring potential for an upward re-rating as investors tend to seek these characteristics in economic conditions such as we are experiencing today. Claus Vorm and Robert Næss, members of NAM’s highly-regarded Multi Assets Team, have managed Nordea 1 – Global Stable Equity Fund for more than 17 years using this process, which they have honed and enhanced along the way. Their active management enables them to optimize the risk/return trade off, and has generated long-term outperformance with below-market overall portfolio risk.3 This fund is classified Article 8 and is MiFID-eligible for clients with sustainability preferences.