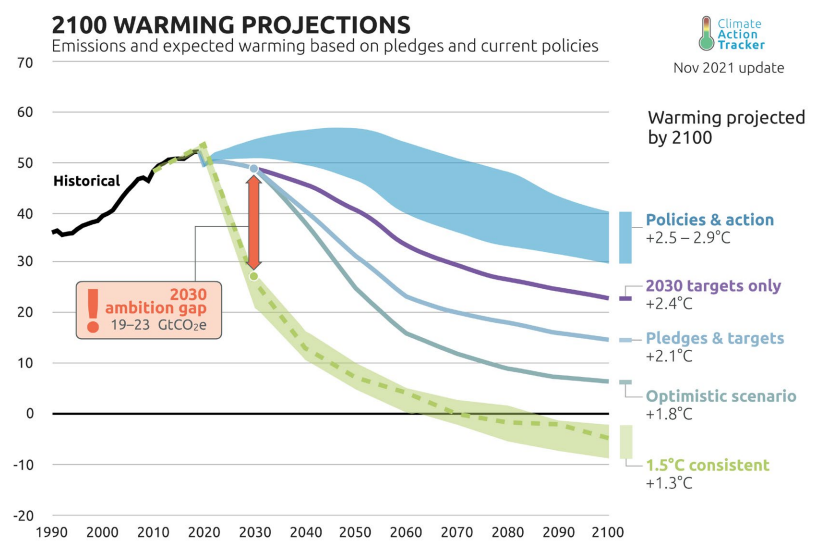

Over the last few years decarbonisation has been a hot topic, with COP26 cementing this as top of mind for governments, policy makers, financiers and the broader public. The move to decarbonise the global economy and achieve net zero is crucial to limiting further global temperature rises. According to Climate Action Tracker, under current policies we are currently on track to reach 2.7C above industrial levels by the end of this century, which could lead to disastrous consequences for the planet. This temperature trajectory should be viewed in the context of our current climate which has already reached 1.1C above pre-industrial levels, and even in this scenario we have seen a rapid increase in the frequency of extreme climate events including floods, forest fires and droughts.

In the context of recent events…

In light of the recent troubling events surrounding the Russia-Ukraine conflict, one might be forgiven for thinking that decarbonisation is no longer a top priority. The conflict has revealed a number of uncomfortable truths including Europe’s overreliance on Russian fossil fuels. It has also triggered broader economic impacts, pushing up global commodity prices and highlighting the fragility of the global food supply chain. Faced with this type of volatile and uncertain environment, it is natural to revert to ‘defense mode’, governments seek to mitigate some of the worst impacts on their economy and population; and companies look to protect their bottom lines to ensure they are able to weather this particular storm.

We’ve recently seen Western governments scrambling to secure alternative energy sources, many of which are unfortunately still fossil fuel based, with countries turning to coal or liquified natural gas imports. Meanwhile the climate crisis still looms large and it remains one of the biggest existential threats facing humanity, so it is important that decarbonisation does not get deprioritised and that our journey to net zero remains on track in order to limit the global temperature increase to 1.5C. UN Secretary General Antonio Guterres recently spoke out about this, condemning even short term reliance on fossil fuels as ‘madness’ on the basis that our addiction to fossil fuels leads to ‘mutually assured destruction’.1 Moreover, rapidly rising energy prices leading to higher energy bills is driving a renewed focus on companies being more energy efficient in carrying out their economic activities. Consuming less energy is not only good for business, helping to protect companies’ bottom lines during periods of higher energy prices; but this also improves a company’s decarbonisation profile. In this scenario, doing well from a decarbonisation perspective goes hand in hand with economic profitability and remaining competitive relative to more carbon heavy peers.

Given the temperature trajectory we are currently on and with emissions predicted to rise by 14% this year, the climate crisis and the importance of decarbonising the economy is not something we can afford to look away from or ‘park for later’. As climate scientists have incessantly warned, if we fail to limit global temperature increases in line with the Paris Agreement (1.5C) we will hit dangerous temperature tipping points which will inevitably lead us in the direction of climate catastrophe. It is tempting to take comfort from the fact that that a lot was achieved at COP26, and whilst some crucial pledges were indeed agreed there, it is far from job done. The lion’s share of the work that is needed to move the needle on carbon emissions lies ahead of us, and will require significant investment and an unwavering focus and commitment from key economic and political players.

What is net zero?

In essence, “Net Zero” refers to a state where the greenhouse gases that are released into the atmosphere are balanced out by the amount that is removed from the atmosphere. Achieving a state of net zero will require a drastic reduction in man-made GHG emissions, and the netting-off of remaining hard-to-abate residual emissions.

For companies, this would mean an almost completely decarbonised value chain, where their operations, products and services, would not create more GHG emissions than the amount they remove, either by producing solutions that absorb emissions from the atmosphere, or by offsetting their emissions in other ways. Given that carbon (CO2) accounts for most of global GHG emissions, decarbonising economic activities is key to achieving net zero, particularly within the G20 who are currently responsible for roughly 80% of global emissions.2

Source: Climate Action Tracker

1) Source: BBC News 2) Source: EPA

Why should we care?

Achieving net zero would limit global temperature rises, and avoid triggering catastrophic consequences for our climate and planet as a whole. Global warming not only effects our climate, but also has wide reaching impacts for the environment, biodiversity and society at large. Research has shown that the impacts of climate change will disproportionately effect more vulnerable and poorer communities, particularly those in emerging markets who are generally less able to protect themselves against extreme climate events, and less well equipped to recover in the aftermath.

Climate change inevitably also poses a serious threat to the global economy, creating significant risks for governments, businesses and households, exacerbated further by the uncertainty around how various climate scenarios could play out. It is no exaggeration to say that climate change is one of the most critical threats faced by our world, and according to the recent report by the IPCC we are nowhere near where we need to be in limiting global temperature rises to safe levels. This underlines the fact that urgent action is needed.

Where do asset managers come in?

As a result of their role in capital markets, asset managers have a key part to play in the journey to net zero. Asset managers are constantly evaluating companies when deciding what to invest in, and as an equity shareholder they may also have the ability to influence company level decisions by way of voting and engagement initiatives. The importance of their role in decarbonisation has been recognized by an increasing number of asset managers in recent years, and several successful industry initiatives have been launched helping to bring these actors together to align their commitments and setting frameworks for achieving them.

…the impacts of climate change will disproportionately effect more vulnerable and poorer communities…

The Net Zero Asset Managers Initiative (NZAM), for which Nordea Asset Management (NAM) was a founding signatory, was launched in December 2020 and now boasts over 200 signatories and covers approximately $57 trillion of AUM. Being an NZAM signatory means that an asset manager is committing to three key things:

- Setting decarbonisation goals consistent with net zero emissions by 2050 across all AUM

- Setting interim (2025-2030) targets for AUM to be managed in line with net zero emissions by 2050 or sooner; and

- Reviewing interim targets at least every 5 years, until 100% of AUM is included.The proportion of an asset manager’s AUM subject to 1.5C aligned reduction targets, is what is considered to be managed in line with net zero.

The proportion of an asset manager’s AUM subject to 1.5C aligned reduction targets, is what is considered to be managed in line with net zero.

Explainer note: What does actually it mean for AUM to be managed in line with net zero?

Every portfolio will have its own carbon footprint, which is essentially the aggregated carbon emissions of all the companies which the portfolio holds positions in. For that portfolio to be managed in line with net zero, a target trajectory needs tobe set to ensure that the carbon footprint can be gradually reduced over time to ensure it will meet its medium to long term goals. In order to set an appropriate net zero trajectory, the asset manager needs comprehensive data in order to analyse how each holding contributes to the overall carbon footprint of a particular fund or portfolio. This will lead the manager to analyse company level carbon emissions, assess who the biggest emitters are and whether they are likely to be able to reduce their emissions over time. Based on this information they will optimize the portfolio accordingly and may engage with some issuers on their decarbonisation plans where feasible.

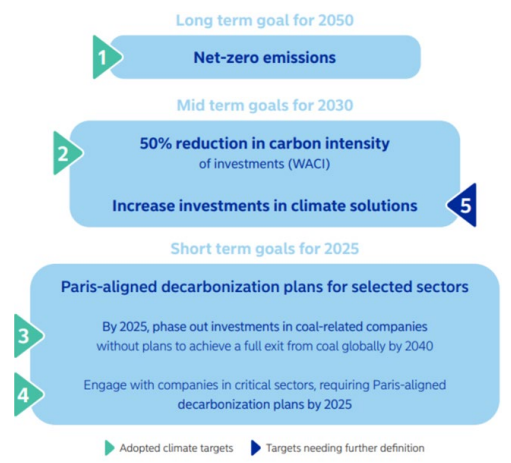

At NAM, we have committed to the following targets:

Now to break some of these targets down and assess what they mean for the funds which NAM manages:

The goal of increasing investments in climate solutions will largely be achieved through our thematic equity funds, which seek to invest in companies providing solutions to environmental or social issues in line with relevant investment themes. The 2030 goal of reducing Weighted Average Carbon Intensity by 50% across the assets we manage will be achieved in two ways:

- Top down targets: Setting fund level carbon reduction targets for 2030. So far 58% of NAMs listed equity AUM is subject to a strategy-specific carbon footprint target for 2030, which includes all of the ESG Stars Equity Funds. The precise target value for any given investment strategy will vary depending on the investment universe and composition of the strategy.

- Bottom-up targets: Drilling down to company level, NAM has set a 2025 target to increase 1.5°C alignment among the top-200 contributors to NAM’s aggregated emissions across listed equity AUM. These issuers currently account for approximately 90% of NAM’s financed emissions in the listed equity space. We are aiming to improve net zero alignment by engaging with these top-200 emitting companies on their net zero transition plans. The companies will initially be assessed and categorized according to various KPIs including their decarbonistion ambitions, targets, disclosures, strategies, and capex alignment. These KPIs will be monitored over time as we aim to improve the levels of net zero alignment within these companies by way of engagement.

Prioritising real world emission reductions

In line with Nordea’s legacy of authentically seeking to achieve sustainable outcomes with our investment solutions, the aforementioned strategy to achieving Nordea’s carbon reduction commitments sets out to prioritise real world emission reductions. What do we mean by that? Essentially there are a number of ways in which a lower portfolio carbon footprint can be achieved; the easiest way would be to divest from the highest emitting sectors such as Industrials, into sectors which appear to be less carbon intensive such as Technology. We do not advocate this as an effective approach to decarbonising a portfolio however, as it achieves nothing in terms of reducing real world emissions. Our top down targets are dynamic and will re-adjust to different sector and regional allocations within the portfolio, ensuring that our investment teams are held to account and achieve real world emission reductions whilst meeting their fund level carbon reduction goals.

The bottom-up targets we have set also prioritise real world emission reductions, as we seek to move the top 200 emitters held across our equity funds in the right direction when it comes to decarbonisation, encouraging them to expedite their plans to transition to more renewable fuel sources. Being active owners is not new to us at Nordea, as we have a strong track record of engaging with companies on specific ESG topics and driving meaningful change by voting at shareholder meetings.

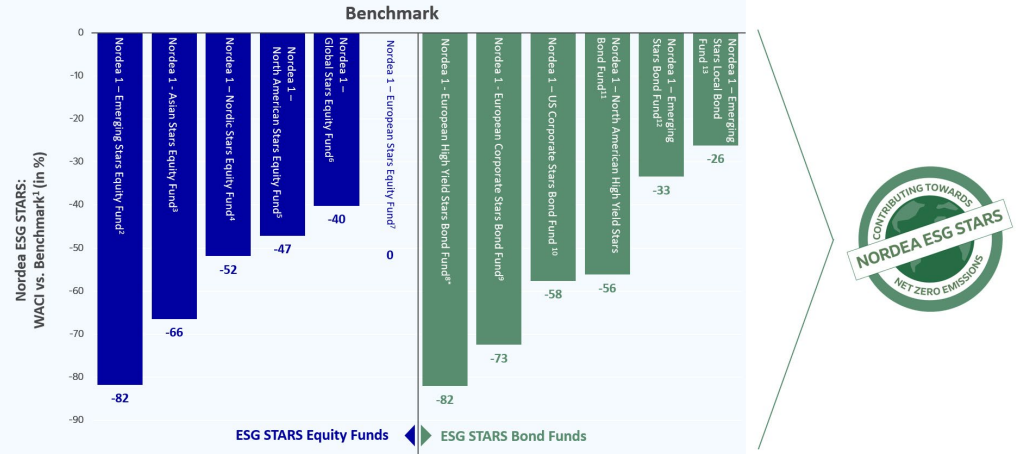

Data as of 31.01.2022. Sources: Nordea Investment Funds S.A. and MSCI. ©2022 MSCI ESG Research LLC.* Reproduced by permission. 1) Data based on the Weighted Average Carbon Intensity (tCO2e/USD million of sales). Source: Data sourced from MSCI Inc. for equities and ISS Ethix for fixed Income. 2) MSCI Emerging Markets NR Index. 3) MSCI All Country Asia Ex. Japan – NR Index. 4) MSCI Nordic 10/40 Index NR. 5) Russell 3000 Index – NR Index. 6) MSCI All Country World – NR Index. 7) MSCI Europe NR Index. 8) ICE BofA European Currency High Yield Constrained Index – Total Return 100% Hedged to EUR. 9) ICE BofA Euro Corporate Index. 10) Bloomberg Barclays Capital US Credit Index. 11) ICE BofA US High Yield Index.12) JP Morgan Emerging Markets Bond Index Global Diversified. 13) JP Morgan GBI Emerging Market Global Diversified. *Low coverage rate of 60.46%. For the display of the Weighted Average Carbon Intensity Nordea requires a minimum coverage rate of 75%. The displayed value of the Nordea 1 – European High Yield Stars Bond Fund is based on a coverage rate of 60.46%.

ESG Stars Equity Funds Decarbonisation building blocks

The ESG Stars Equity Funds are NAMs flagship benchmark constrained equity funds, spanning several regional flavors. As detailed below, each of these funds has its own 2030 target for reducing its carbon footprint. As a result, these funds can act as essential building blocks for asset owners looking to achieve their own 2030 and 2050 portfolio decarbonisation targets. An allocation to one or more of our ESG Stars Equity Funds in a portfolio will proportionately contribute to the net zero alignment of that portfolio.

Not only are the ESG Stars Equity Funds managed in line with net zero with respect to their medium & long term carbon targets, allocating to one or more of these funds can also have a decarbonsing effect in the short term. When analysing the current carbon credentials of the ESG Stars Equity Funds relative to their respective benchmarks, NAM’s flagship equity funds account for a much lower Weighted Average Carbon Intensity (WACI) as illustrated below. This means that allocating part of a broader equity portfolio to one or more of the ESG Stars Equity Funds, could help achieve a lower WACI for the overall portfolio. When it comes to decarbonisation there is no need to sacrifice instant gratification to achieve your long term goals, investing in our ESG Stars Equity Funds allows you to do both.

Conclusion

At NAM we are proud to have allocated significant resources to our decarbonisation efforts so far. We believe the firm level pledges we have made and the fund level targets we have set, are ambitious yet achievable and we look forward to engaging with more underlying companies, supporting and encouraging them on their journey to net zero and achieving real world emission reductions. At fund level we are well positioned in our ability to provide the right tools and building blocks in order to help asset owners decarbonise their portfolios, which we believe will be of critical importance to decarbonising the broader economy and achieving crucial climate goals. ‘Every fraction of a degree matters. Every voice makes a difference. And every second counts.’3

3) UN Secretary-General’s remarks on the launch of the intergovernmental climate change report (IPCC). The UN Secretary-General Antonio Guterres (28 February 2022) https://www.unicef.org/

vietnam/press-releases/un-secretary-generals-remarks-launch-intergovernmental-climate-change-report-ipcc

*investing for their own account – according to MiFID definition