Key highlights

- Fixed income managers can play an important role in the fight to curb deforestation in the Amazon as they have the ability to hold governments responsible by applying pressure.

- Investors should be concerned about deforestation of the Amazon rainforest, which contributes to climate change and can add risk to portfolio assets.

- Last year, the team behind Nordea’s Emerging STARS Bond Strategy engaged with the Brazilian government to address its policies and actions concerning destruction of the Amazon rainforest

- Nordea Asset Management (NAM) joined 29 investors in demanding the Brazilian government curb deforestation and protect the rights of indigenous people there. NAM also suspended the purchase of Brazilian government bonds.

- NAM has initiated an ongoing dialogue with Brazilian government officials, who have offered reassuring responses. There is also evidence of positive corporate action in Brazil.

- NAM’s engagement efforts to curb deforestation continue.

Fixed income strategies with true ESG integration represent a relatively new approach to Responsible Investment. Nevertheless the market is beginning to take notice – there is growing recognition among Emerging Markets investors that ESG issues can present material credit risk with respect to sovereign debt. “Given the increasing economic importance of emerging markets, EM Debt is likely to continue delivering attractive risk-adjusted returns in the medium to long term,” says Thede Rüst, Head of Nordea’s EM Debt Team and manager of Nordea’s Emerging STARS Bond Strategy. “In the same way that ESG risk is an important factor in EM equities, it can be particularly material in the EM debt environment.”

Active ownership is central to Nordea Asset Management’s (NAM) Responsible Investment (RI) philosophy and ESG approach. It is an important way to protect and enhance the value of the portfolios we manage on behalf of our clients. While most engagement focuses on companies, it this also possible for a Sovereign Fixed Income portfolio. This ESG Insight provides a case study of how NAM engaged with the Brazilian government to address its actions in the Amazon rainforest through the vehicle of Fixed Income investment.

Fixed Income as an engagement tool in the Amazon rainforest

Did you know?

- The Amazon rainforest acts as a giant sponge, draining two billion tons of carbon dioxide a year from the atmosphere – 5% of annual emissions – as trees grow. This makes it a vital part of preventing climate change.1 Tropical rainforests, here and elsewhere, are particularly effective at cooling the planet because they grow fast and release massive amounts of water to form clouds1

- However, up to one-fifth of the Amazon rainforest is emitting more carbon dioxide than it absorbs, as emissions from dead trees outnumber absorption by live ones1

- The region has perhaps the greatest biodiversity in the world. For example, Brazil, home to 60% of the forest, has the highest number of known plant species: 55,000.1 New species of flora and fauna are being discovered all the time – sometimes in threatened areas. In 2019, scientists found a monkey unknown to science in a vulnerable expanse of Brazilian forest

The world’s tropical rainforests play a vital role in keeping life on earth hospitable and even viable – by absorbing carbon dioxide, they slow global warming. They also have the richest store of nature on the planet. If used sustainably, they can provide millions of people with a livelihood in perpetuity.

However, these rainforests are under threat from human destruction – mainly to make way for farming, but also to clear roads for mining. This unleashes some hair-raising problems. As trees are cut down, the dead wood emits carbon dioxide rather than absorbing it; this accelerates climate change. The destruction of rainforests endangers iconic species such as the jaguar. As people disturb the forest, those creatures that are not killed are often displaced – increasing the risk that diseases originating in animals are passed to humans, just as Covid-19 was. The first people to catch the deadly Nipah virus, back in 1997, did so from fruit bats forced to flee their habitat in the Indonesian rainforest, as the smoke from burning trees destroyed the fruit they fed on.1

Investors care increasingly about such destruction as it is increasingly material to their investments. Global warming is a growing threat to asset prices. For example, the threat to people’s livelihoods from extreme weather may destabilise political and economic systems. Moreover, companies and governments that lag in ESG practices can represent increased risk to portfolios.

Why investors should be concerned about deforestation in the Amazon

November 2020 brought grim news from INPE, Brazil’s space agency. Forest destruction reached a 12- year high, with a 9.5% increase in the amount razed to the ground over the previous year, to 11,088 sq km.2 That is about the size of Jamaica.

The scale of destruction has increased since early 2019 When the head of state encouraged an expansion of cattle grazing, soya cultivation and mining in the region. Meanwhile, the government cut funding to federal agencies that have the power to fine and arrest farmers and loggers breaking environmental law by destroying forest. As well as bulldozing trees, people remove them by lighting fires. This burning is generating a negative feedback loop: it interferes with rainfall above the rainforest, leaving it drier and more susceptible to natural fires.3

At Nordea Asset Management, we are highly concerned about Brazil’s climate policy. It is financially material to our portfolios as it poses reputational, operational and regulatory risks that can have an impact on sovereign bonds.

Climate change will hit our portfolios in general, by reducing the planet’s productivity and therefore economic growth. This is the case for all asset classes, but is particularly important for our fixed income strategies, since issuers have to be able to pay coupons and redeem bonds far into the future. For example, the ability of some governments to repay the principal on a 30-year bond may be severely compromised in 2050, if the climate in their countries is much worse.

The destruction of the Amazon rainforest will also hit Brazilian assets in particular. Consumers, companies and governments will be more reluctant to deal with companies implicated in the destruction, such as agribusinesses using former forest land or meat processors using cattle that have grazed on it. The damage to offending businesses will hit the value of their shares and bonds. The prices of these securities will also fall because investors will be wary of the reputational risks of buying these assets.

The same holds true for Brazilian government bonds. The Brazilian economy, as a whole, may also grow more slowly, harming the value of all assets in Brazil and even those of its neighbours, if it becomes more isolated. France, Ireland and Austria have said they will block parliamentary ratification of a trade agreement between the EU and the Mercosur bloc, that includes Brazil, Uruguay, Paraguay and Argentina, unless the Brazlian government agrees to do more to tackle Amazonian deforestation.4

Fixed Income investment can play a role in curbing deforestation

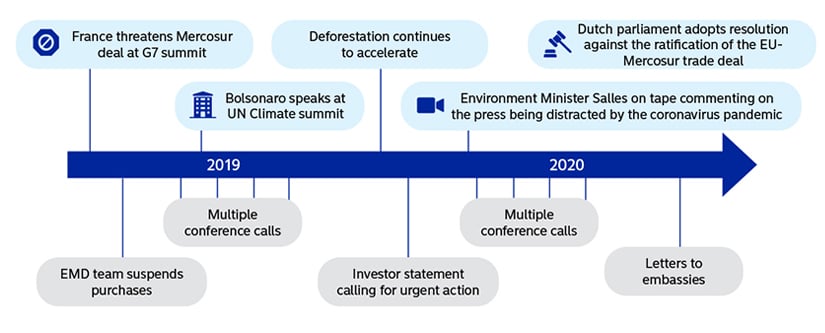

Fixed Income managers can play an important role in the fight to curb deforestation in the Amazon as they have the ability to hold governments responsible by applying pressure. Nordea Asset Management’s Emerging Markets Debt Team did this in 2019 in response to the threat deforestation posed to the value of Brazilian sovereign bonds.

Citing the negative financial materiality of the rainforest destruction, in 2019 we decided we would no longer buy Brazilian government bonds for any of our internally managed Emerging Market debt strategies, including Nordea’s Emerging STARS Bond strategy.

In July 2020, Nordea Asset Management became a founding member of the Investors Policy Dialogue on Deforestation (IPDD). The IPDD engages with public agencies and industry associations on this issue – initially in Brazil, where the need is most urgent, but with plans to engage with other countries too. It has set out a series of demands for the Brazilian government. These include:

- A “significant reduction in deforestation”

- Public access to data that allows cattle and other commodities to be traced as they pass through supply chains

- Removing obstacles that prevent agencies, tasked with enforcing environmental and human rights legislation, from doing their jobs

In June 2020, 29 investors signed a letter of concern and sent it to the Brazilian government demanding that it curb deforestation and protect the rights of indigenous people. As an outcome to the letter, NAM was invited to a call with Roberto Campos Neto, the president of the Brazilian Central Bank. This led to further dialogues with the Brazilian vice president, Hamilton Mourão and different ministers who are part of the Amazon council.

Consequently, Nordea Asset Management and eight other leading investors were invited to discuss deforestation with the Brazilian government. In addition, Rodrigo Maia, president of the Chamber of Deputies, responded with a tweet that made two reassuring points: he has declared that the Chamber will not pass any environmental laws that damage Brazil’s image; and that the country needs to rebuild trust among foreign investors. Both Maia and the head of the central bank, Robert Campos Neto, have also emphasised that the Brazilian government needs to give the investor group satisfactory answers.

Another point that I want to highlight is that the Chamber did not vote and will not vote on matters related to the environment that could erode Brazil’s image abroad. These are two very sensitive issues that directly impact investments in Brazil: democracy and the environment. Rodrigo Maia

Leading Brazilian banks and companies responded with a letter of their own to the government that carried a similar message. The IPDD has since swelled to 43 members responsible for about USD 6 trillion in assets under management.

“We are very concerned about Brazil’s climate policy”, says Thede Rüst, Head of Emerging Market Debt at Nordea Asset Management and manager of Nordea’s Emerging STARS Bond Strategy. “We are worried about the financial impact that deforestation may have on portfolio companies by increasing reputational, operational and regulatory risks. We have also stopped any further investment in Brazilian government bonds because of the risk that the EU-Mercosur free trade agreement could be jeopardized by forest destruction.”

Extending our reach beyond Brazil

Sadly, the problem of deforestation is not limited to the Amazon. It is also a growing challenge in Indonesia, where every two minutes, a rainforest the size of a football field is cut down to make room for palm oil plantations.

For Nordea Asset Management’s Responsible Investments (RI) team, the issue is front and centre because deforestation has pushed Indonesia into the top tier emitters of global greenhouse gas emission and threatens endangered species.

The team visited Indonesia to meet with palm oil producers, NGO’s and small-holder farmers to gain a deeper understanding of the problem. While there, they began an engagement with a bank that is a major financier of palm oil plantations.

The bank acknowledged the ESG risks it faces related to palm oil financing, and has begun implementing ESG risk management for its palm oil plantation loans. It now requires palm oil producers to have a certification attesting to sustainable practices.

In keeping with Nordea’s mission to deliver returns with responsibility, the RI team will continue this engagement effort to make palm oil plantations more sustainable5.

Rainforest deforestation in the Amazon and elsewhere is a major threat to the global climate and economy, and an even greater threat to countries where it is happening. The liability is gravest of all for companies and governments responsible for the deforestation, because of the risk of shunning by consumers, investors and governments.

For these reasons, deforestation is a vitally important issue not merely to investors in the niche field of ethical investment. It is relevant to every investor, because it threatens the value of assets they hold, and affects which assets they might choose to buy in the future.

In common with other investors, we have responded with concrete action – freezing investments in Brazilian sovereign bonds and even disinvesting from Brazilian meatpacker JBS. Both JBS and senior public figures have listened, showing that investors can wield a great deal of power. Neither JBS nor the Brazilian government have done enough yet to make us change our investment stance – but we are encouraged by their progress. In the meantime, we will act in the interests of our clients by keeping up the pressure.

Nordea’s engagement activities in Brazil

What has been achieved, so far

Engagement has always been a key pillar of Nordea’s ESG STARS strategies, with many successful interactions on the corporate side. We have also brought this approach to the sovereign space – which initially raised questions about just how much impact was possible in this area.

We are seeing positive corporate actions in Brazil. It is clear some of the corporate citizens of Brazil are realising these pressures and are seeking innovative solutions. For example, paper and pulp company Suzano, a group we are invested in, came up with an interesting structure of issuing carbon-linked bonds. This essentially means if Suzano does not reduce its emissions, it will have to pay a higher coupon.

Our suspension of Brazilian government bond purchases has won the attention of both government agencies and the media. We are part of a collaborative investor initiative engaging with Brazil and our actions are really gaining momentum. The engagement is ongoing, with our Fixed Income team on the front line.

1 “Deforestation is leading to more infectious diseases in humans”, National Geographic, November 22 2019.

2 “Brazil’s Amazon: ‘deforestation surges to 12-year high’”, BBC, December 1 2020.

3“Human activities are drying out the Amazon”, Nasa, November 5 2019.

4“EU seeks Amazon rainforest protections pledge from Bolsonaro in push to ratify trade deal”, The Guardian, October 20 2020.

5 There can be no warranty that an investment objective, targeted returns and results of an investment structure is achieved. The value of your investment can go up and down, and you could lose some or all of your invested money